New Writing: Held in the heart of the City of London, the UK International Investment Summit was the first big test of the new government’s business credentials. Writing for The Hub, the award-winning content platform curated by Mitsubishi Electric, Jim McClelland asks the question: Did the world of money like what it saw?

Taking place just 24 hours after the new Government celebrated its first 100 days in power, the International Investment Summit on 14 October was always going to be seen as both a showcase for its pulling power and a test of market confidence in the wider UK economy.

The audience was also on the lookout for any hints or slips that might provide a clue as to what to expect from the inaugural Budget due at the end of the month (Wednesday 30 October).

Hot topics might include any talk of tax — whether in the form of incentives for R&D, or rates for corporations — and support for start-ups or scale-ups, plus international trade.

Given the Labour Party’s very on-off love-affair with the investment community over the years, this event represented an opportunity to really sound the opening bell for business and finance under the new regime.

So, did the UK’s cash-strapped Chancellor ultimately get the money in the till?

Sector breakdown in step with policy

Well, yes. According to official figures, nearly 38,000 jobs will be created across the UK thanks to some £63 billion in total investment. As has been pointed out, however, almost a quarter of that sum had actually been secured before the current administration took office.

Nevertheless, the record-breaking sum is still more than double the £29.5 billion last year.

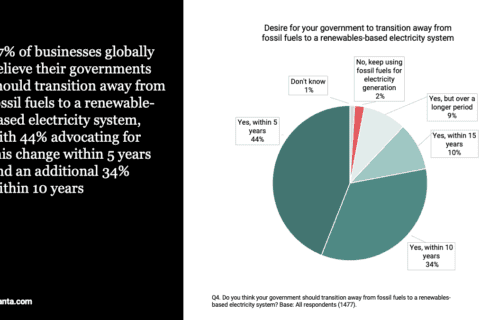

The new government has taken credit for key investments being directly attributable to immediate action on its part to reform planning, focus on artificial intelligence (AI) and data centres, plus commit strongly to net zero by almost doubling funding for renewables.

There is some compelling evidence of core policy alignment to be found in the itemised breakdown of the overall Summit cash-haul by sector, as well as in the names of principal investors.

Will regulation be a barrier or enabler?

Going forward, however, whilst the Pound signs might have grabbed most of the media attention, there is more to the UK being investible over time than mere maths.

A critical component of ongoing economic stability, as well as a driver for innovation, is something often wrongly seen as a barrier to enterprise and growth: regulation.

Especially for investors focused on environmental, social and governance criteria (ESG), upcoming changes to the regulatory landscape signpost the direction of travel in the UK.

When it comes to money flows, in and out, laws and legislation matter: from the impending Sustainability Disclosure Requirements (SDR) of the Financial Conduct Authority (FCA), to the Government’s own Employment Rights Bill and Great British Energy Bill.

So, whilst the Summit might have served as a shop-window for investors, it will be the small print of policy and regulation that will ultimately keep them — to read more, check out the full-length article on The Hub:

Show me the money, then read me the regs!

To view a back-catalogue of articles authored by Jim McClelland for ‘The Hub’, please see archive here.

SUSTMEME: Get the Susty Story Straight!