Surging demand and questionable supply could push carbon offset prices to unsustainable highs or ill-fated lows, according to research that models scenarios through to mid-century. At most, prices could jump 50-fold by 2050.

Prices for carbon offsets — verified emissions reductions equivalent to one ton of carbon each — could be as high as $120/ton, or as low as $47/ton in 2050, according to the Long-Term Carbon Offset Outlook 2022 report from research company BloombergNEF (BNEF). The outcome will mostly depend on what types of supply are eligible to meet the rapidly expanding universe of sustainability goals, as well as who the primary customers are in the market.

Should all types of offsets continue to be permitted, including those which avoid emissions otherwise occurring, the market will be oversupplied with largely worthless credits, thereby driving prices down and attracting criticism.

A jump in corporate demand, specifically from heavy-emitting industries with no alternatives to offsets, could bridge this gap and lead to moderate increases in prices, but many companies are hesitant to invest further.

Conversely, if the market is restricted to just offsets that remove, store or sequester carbon, there will be insufficient supply to keep up with demand, causing significant near-term price hikes and damaging liquidity.

If the market evolves primarily to help countries achieve their climate targets rather than companies — as mooted at COP26 — it will soften this supply shortfall. Yet, this is still not ideal for the long-term success of carbon offsets.

Patience will prove a virtue, says Kyle Harrison, head of sustainability research at BNEF and lead author of the report:

“There will be growing pains in the coming years as stakeholders try to understand how to sustainably grow the carbon offset market and determine who it will serve. If done correctly, their patience could be rewarded with a market valued at more than $550 billion by mid-century. Suppliers, buyers of offsets, traders and investors will need to balance what is idealistic and what is realistic. Otherwise, they risk the offset market burning out just as it’s getting started.”

Three scenario models for supply, demand and price

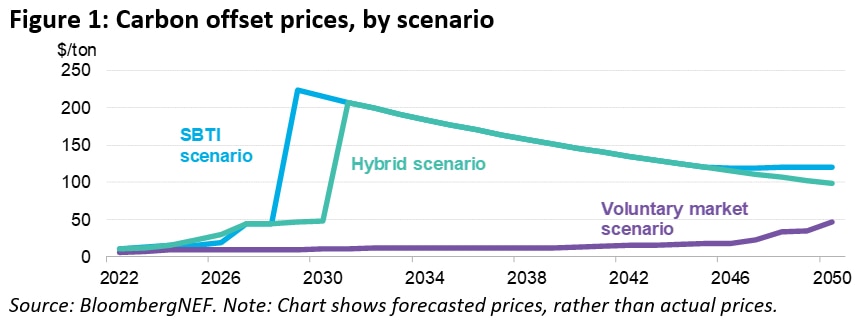

In the report, BNEF models supply, demand and prices for carbon offsets under three scenarios: a voluntary market scenario, an SBTI (Science Based Targets initiative) scenario and a hybrid scenario. Offset prices range from $11-$215/ton in 2030, up from just $2.50 on average in 2020, before narrowing to $47-$120/ton in 2050.

The voluntary market scenario assumes the offset market remains similar to how it looks today. Demand comes from corporations with sustainability goals and surges to 1 billion metric tons of carbon dioxide equivalent (GtCO2e) in 2030 and 5.2GtCO2e in 2050 — the latter of which is equivalent to 10% of global emissions today.

All types of supply are permitted, including offsets that avoid emissions rather than removing them — such as clean energy and avoided deforestation. Due to the lack of regulation, supply is nearly four times greater than demand in 2030 and is still 30% greater in 2050. This supply glut keeps prices down to just $11/ton in 2030 and $47/ton in 2050.

Low prices give companies flexibility to meet their sustainability goals, but subsequently undermine their ability to drive true additional decarbonisation, inviting criticism for a lack of quality. Low prices also provide developers and traders with little financial incentive to participate, meaning the market never takes off and is relegated to back-alley deals for low-quality credits.

The SBTI scenario limits supply to removal offsets like reforestation and nascent technologies such as direct air capture. Activity is still driven by corporations, but only for offsets that store or sequester carbon, rather than avoiding emissions that would otherwise happen. This is an outcome pushed by a number of groups, with the Science Based Targets initiative leading this narrative.

The SBTI scenario addresses the supply glut seen in the voluntary market scenario, but may be overcompensating: the market is undersupplied by 2029 and prices shoot up to $224/ton. By 2050, even with technologies like direct air capture becoming more widely adopted, there is still only enough supply to meet less than 90% of demand and prices sit at $120/ton.

These prices would alleviate concerns around offset quality and could even push companies to focus more on reducing their own gross emissions, as offsets will be too expensive. However, this scenario underscores how dire the supply shortfall could become in a removal-only world — particularly in the early years when technology-based removal barely exists, relegating offsets to a niche, luxury product.

The hybrid scenario looks at a gradual evolution of the offset market, from the voluntary market today, to a removal-only market for corporations and finally to a removal-only market primarily for countries, rather than companies, by mid-century. This assumes that a global carbon market allowing countries to buy and sell verifiable emission reductions — similar to what was being discussed under Article 6 at COP26 — overtakes the current company-run market. Prices rise to a manageable $48/ton in 2030 before shooting up to $217/ton the following year and gradually dropping to $99/ton in 2050.

While the price outcome of the hybrid scenario is more ideal for all parties involved, it assumes some major market developments in the coming years and is still an unpalatable jump from today’s prices.

Whatever outcome prevails, change is a given for carbon offsets and business must adapt, concludes Harrison:

“No matter the scenario, corporations and other entities looking to buy carbon offsets shouldn’t expect them to be a get-out-of-jail-free card for much longer. As the market matures — which it will — and processes are put in place to make offsets resemble a traditional commodity, prices will inevitably rise and companies will need to prioritise their gross emissions more than ever.”

BloombergNEF (BNEF) is a strategic research provider covering global commodity markets and the disruptive technologies driving the transition to a low-carbon economy. BNEF updates its historical offset supply and demand data monthly and its long-term outlook annually.

Further Reading:

- More about BloombergNEF;

- More about the Science Based Targets initiative (SBTi);

- Also on SustMeme, Hope not hype: Holding out for a net zero hero;

- Also on SustMeme, Energy transition investment hits $500 billion for first time;

- Also on SustMeme, Clean cryptocurrency: World’s first tradable carbon token.

- Also on SustMeme, Standard to be set for science-based net-zero targets.

>>> Do you have sustainability news to broadcast and share? If you would like to see it featured here on SustMeme, please use these Contact details to get in touch and send us your Press Release for editorial consideration. Thanks.