Despite growing demand and record-breaking supply of renewables, a new status report warns the global energy transition is stalling, held back by regional disparities, plus inaction on heat and fuels.

The warning comes with publication of the Renewables in Energy Supply module of the Renewables 2024 Global Status Report (GSR 2024), released by the REN21 global policy network this week.

The research reveals that, whilst we are now generating 30.3% of our electricity from renewables, urgent action is still needed on heat and fuels, which deliver three-quarters of energy supply.

Overall, renewables are being held back by a trio of key factors:

- Wide disparities in investments and focus across different energy carriers, regions and technologies;

- Inadequate policy integration that hinders alignment on energy consumption and supply; plus

- Delays in infrastructure development, which are putting the brakes on advancement.

Record growth, but lack of technology mix

It is not all bad news, of course.

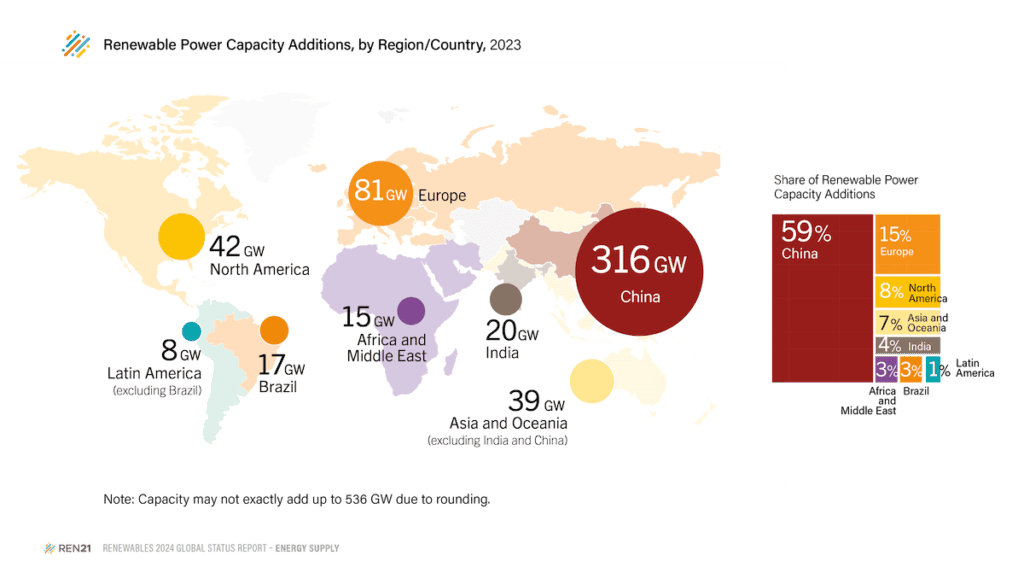

There is clear evidence of growth in renewables, which accounted for 86% of capacities added for power in 2023. The 54% increase in global renewable power capacity additions saw totals reaching 536GW.

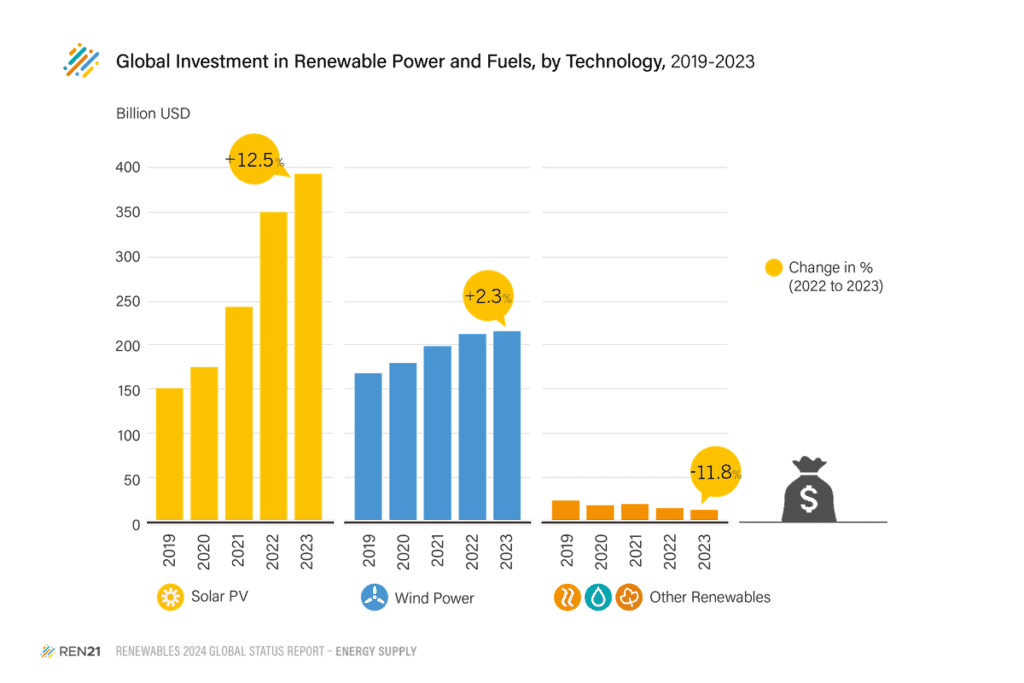

This expansion, though, was dominated almost exclusively by just two primary renewable energy technologies, with solar PV (407 GW) and wind (117 GW) making up almost all addition (98%).

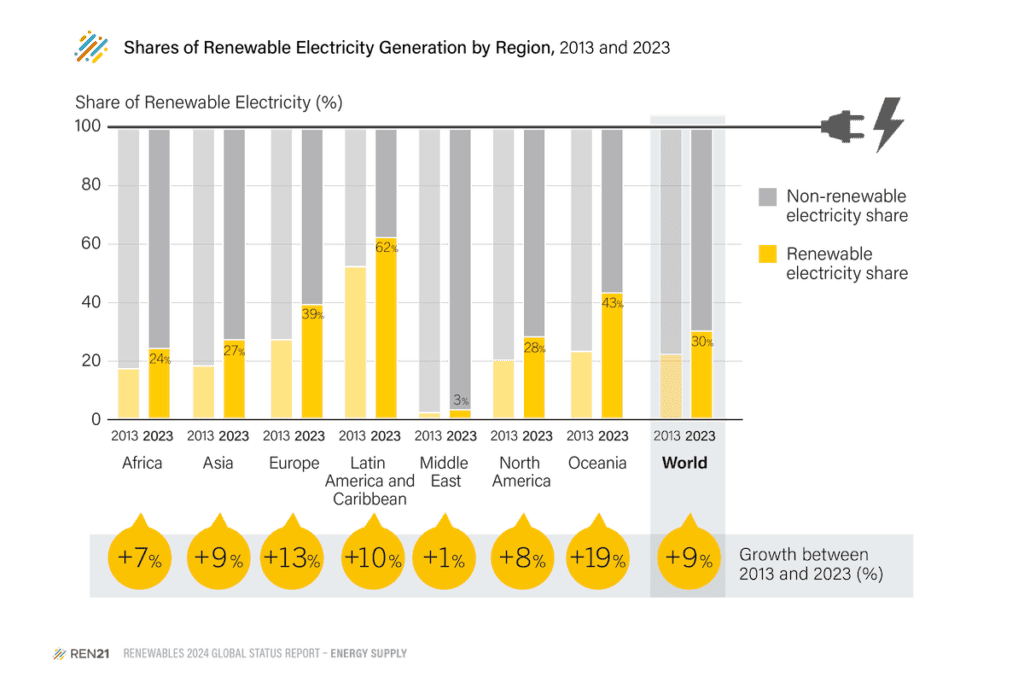

Only three regions had more than 35% renewable electricity in their power sector using different technologies: Latin America and the Caribbean, Oceania, and Europe.

Latin America and the Caribbean led with 62%, up from 52% in 2013, mainly due to hydropower. Oceania increased from 23% in 2013 to 42% in 2023, largely due to Australia’s 9% growth in renewable power generation, primarily from solar PV and wind.

Europe had 39% renewable electricity. Africa (24%) and the Middle East (3%) had the lowest shares.

Progress slow, with damaging regional disparity

As well as a tech imbalance, the findings exposed unhealthy concentrations in geographies, as well.

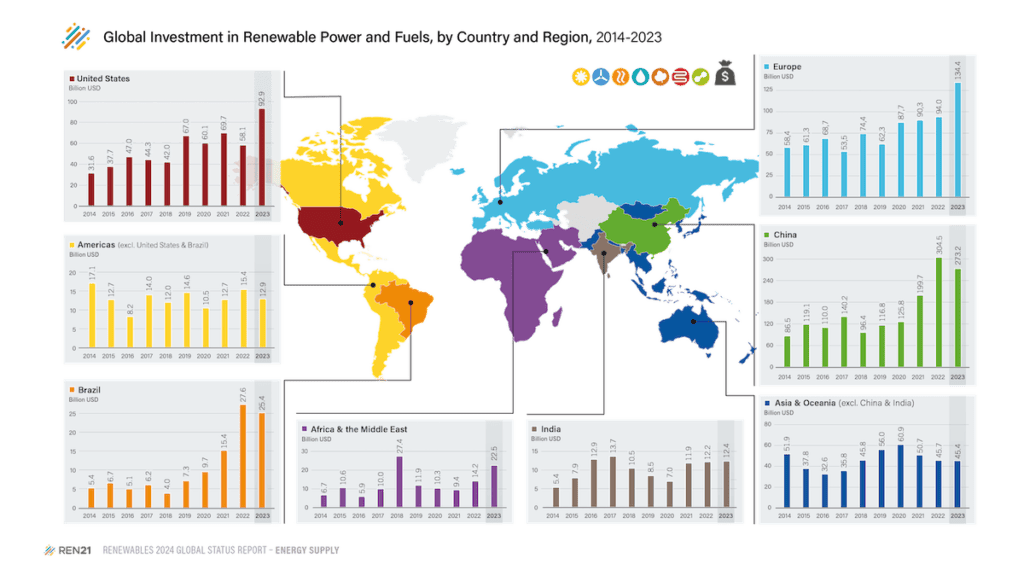

China is leading the way in renewable power capacity additions, followed by the US and Europe. However, the report highlights how regional disparities characterise the energy transition.

It reveals that less than 18% of capacity additions are in Asia (excluding China), Latin America, Africa and Middle East, despite these regions representing almost two thirds of the global population.

So, despite record deployments in the power sector, renewables are still struggling to keep pace with growing global demand for energy. The shortfall is most visible in heat and fuels, where renewables only provide 10% and 3.5% respectively. As a result, use of fossil fuels inevitably continues to rise.

Overall, progress is too slow to align with a 1.5°C trajectory, says REN21 Executive Director Rana Adib:

“Even in the power sector, which is celebrated as a success story for renewables, we are not moving fast enough to fully meet the staggering rise in energy demand, let alone replace existing fossil fuels.

“Without structural transformations and reforms of the fossil-fuelled energy system, we will not be able to build renewables-based resilient economies free from coal, oil and gas.”

Shortfalls in renewables seen most in heat and fuel

The GSR Renewables in Energy Supply module covers the way final energy is supplied and delivered by different energy carriers, namely: heat, fuel and electricity.

It also explores the technology mix: bioenergy, geothermal power and heat, heat pumps, hydrogen, hydropower, solar PV, concentrated solar power (CSP), solar thermal heat, ocean power and wind.

Energy is delivered to consumers through electricity, heat, solid, and liquid and gaseous fuels. Currently, almost half of global energy supply comes from heat (48%), followed by fuels (29%) and electricity (23%).

In 2023, renewables provided a record 30.3% of global electricity, mainly owing to long-term policy attention that enabled market and technology development and drove down costs. China, Europe, the US and Brazil are the main countries which contributed to the remarkable 54% growth in additions.

However, renewables do not yet cover rising demand and the use of coal, oil and gas in the power sector grew by 18% between 2011 and 2021. Renewables provided only 10% of heat and 3.5% of fuel supply in 2021. Heat is mainly used in buildings and industrial operations and fuels for transportation.

Fossil fuels are also still heavily subsidised (US$600 billion in 2023) and dominate global energy supply with a 79% share. At the same time, governments have neglected the carriers – heat and fuel – that meet most of the world’s energy demand, significantly holding back the energy transition.

Joined-up thinking and doing is vital if we are to meet development and climate goals, argues Adib:

“Fossil phase-out, energy efficiency and renewable energy form the trinity of the energy transition. All three must go hand in hand, otherwise we will not achieve the system change needed.”

Broad investment needed to catch up on NDCs

At the COP28 climate summit in Dubai, governments agreed to triple renewable energy capacity and double energy efficiency improvements by 2030.

Now, as countries prepare to submit updated Nationally Determined Contributions (NDCs) under the Paris Agreement, there is an opportunity to strengthen commitments to renewables, urges Adib:

“Countries must absolutely catch up in the next round of NDC submissions in 2025 and raise ambition with clear commitments. We are running out of time.”

The global deployment and investment landscape is highly unequal, with most advancements in China, the EU, and the US, where substantial policy action and financial incentives are spurring strong growth in solar PV, wind, and energy storage, along with enhanced manufacturing capacity.

Globally, China maintained its leading position in new renewable power investments, reaching 44% in 2023, followed by Europe (20.9%), and the United States (15%).

Africa and the Middle East combined received only 3.6% of global investment in renewables.

In fuels, the US supplied 40% of the total of renewable biofuels in 2022, followed by Brazil (21%) and Indonesia (6.2%). Germany emerged as the European leader in biofuel production (2.8%).

Systemic infrastructure issues also persist. In the power sector, 1.5TW of renewables are stuck in grid connection queues, equivalent to three times the installations of solar PV and wind power in 2023.

“This is wasted renewable capacity”, concludes Adib. “It’s like building the trains without the rails.”

Global policy network of renewable energy actors

REN21 is the only global policy network made up of renewable energy actors from science, academia, governments, non-governmental organisations and industry across all sectors.

All REN21 knowledge activities follow a unique reporting process that has allowed the organisation to become globally recognised as a neutral data and knowledge broker.

Since the first GSR release in 2005, REN21 has worked with thousands of contributors to spotlight the ongoing developments and emerging trends shaping the future of renewables.

Producing this annual report is a collaborative effort of hundreds of experts and volunteers who contribute data, review chapters and co-author the report contents.

The new Renewables in Energy Supply module follows release of GSR 2024 Renewables in Energy Demand, which explored the key energy-consuming sectors of buildings, industry, transport and agriculture.

REN21 also released the Global Overview in April 2024. It provided the big picture status of renewables in the wider energy system in the context of global challenges such as climate change, economic development and the geopolitical landscape. Upcoming modules will focus on Renewable Energy Systems and Infrastructure, and Renewables for Economic and Social Value Creation.

Further Reading:

- More about the REN21 global policy network;

- Explore the interactive online version of the Renewables 2024 Global Status Report (GSR 2024);

- More about the Renewables in Energy Supply module; plus Renewables in Energy Demand;

- Also on SustMeme, Record, but inequitable, growth in renewables;

- Also on SustMeme, Hydrogen refuelling boost for California bus fleet;

- Also on SustMeme, Scotland green lights floating offshore wind farm;

- Also on SustMeme, World’s biggest vanadium flow battery will time-shift solar in Australia;

- Also on SustMeme, Lithuania to move beyond biomass in record energy transition;

- Also on SustMeme, Energy transition to add 40 million jobs by 2050;

- Also on SustMeme, Call to invest $35 trillion in transition tech by 2030;

- Also on SustMeme, Solar and wind now cheapest for 2 in 3 people worldwide;

- Also on SustMeme, Season 28 of the greatest COP show on Earth.

Check out the full archive of stories on the SustMeme Climate & Energy Channel, now available to Sponsor.