Plant-based protein production has increased dramatically in recent years, racing to keep pace with rising demand from a growing global population. The market share per crop is set to change though, according to new reseach just published. So, whilst soy might dominate today, diversity of sources, scalability and regional considerations will prove key in future, as the likes of pea, canola and oat look poised to enjoy a rapid expansion.

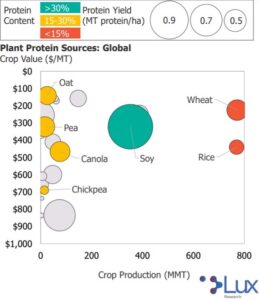

In the new report Plant Proteins: Present & Future, Lux Research analysed 24 different plant protein sources on crop production factors globally and for three major regions: North America, Europe, and Asia.

Overall, Lux identified soy, wheat, and rice as the top three ‘staple’ crops for plant protein, with pea, canola, oat, and chickpea as the ‘alternative’ up-and-comers.

For North America and Europe, soy and wheat are the top plant protein sources, respectively, but given their extensive nonfood uses, along with the general diversification, pea, oat, and canola are more attractive opportunities going forward.

Oat and canola are particularly appealing, as numerous companies are already scaling-up pea protein production, investing nearly half a billion dollars in facility construction since 2017.

Asia is in a unique position, given that the region has a near monopoly on several crops. Two of these are rice and chickpea, with Asia responsible for 90% and 75% of global production, respectively. These are not as widely used for protein ingredients as the other short-listed crops, which highlights their untapped potential.

The market context for these crop trends is that three major storylines are shaping the plant protein space at present: the rise of insurgents like Beyond Meat; the proliferation of product launches from large multinational corporations (MNCs) like Tyson; and the onset of trade uncertainty from events like the US-China trade war.

The signs are there for soy, says lead author of the report and Lux Research Analyst Thomas Hayes:

“The storylines signal the need for the diversity of protein sources as both startups and MNCs move beyond soy, and for those sources to be capable of not only supporting the increasing supply requirements of these companies but also regional self-sufficiency to mitigate trade risk.”

Looking to the future, food tech has a key part to play too, he adds:

“Technology innovation will play an important role in unlocking new plant-based protein opportunities, especially when combined with sources that are affordable, accessible, and abundant.”

Gene editing or advanced breeding approaches will increase protein content in crops, while innovative extraction methods will enable new crops as sources of protein isolates and concentrates.

A leading provider of tech-enabled research and advisory services, Lux also predicts that novel processing technologies and ingredients will improve the sensory and nutritional qualities of plant-based proteins. Such innovations will allow growers to demand a premium, defray protein extraction costs downstream, further broaden the consumer appeal of plant-based products, and more.

Further Reading:

- View and download the Executive Summary of the Lux report.

- More about Lux Research.

>>> Do you have sustainability news to broadcast and share? If you would like to see it featured here on SustMeme, please use these Contact details to get in touch and send us your Press Release for editorial consideration. Thanks.